Laen Eraisikult: A Practical Solution for Your Financial Needs

In today's fast-paced world, financial stability is a crucial aspect of life. Whether you are looking to fund your dream home or manage unforeseen expenses, the search for the right financing option can be overwhelming. One increasingly popular solution is obtaining a laen eraisikult, or loan from a private person. This article delves into the ins and outs of private loans, their benefits, and how you can leverage them to enhance your financial situation.

What is a Laen Eraisikult?

A laen eraisikult refers to a financial arrangement where individuals lend money to each other directly, bypassing traditional financial institutions such as banks. This type of loan can be particularly advantageous for those who may not qualify for standard bank loans due to credit history or personal circumstances.

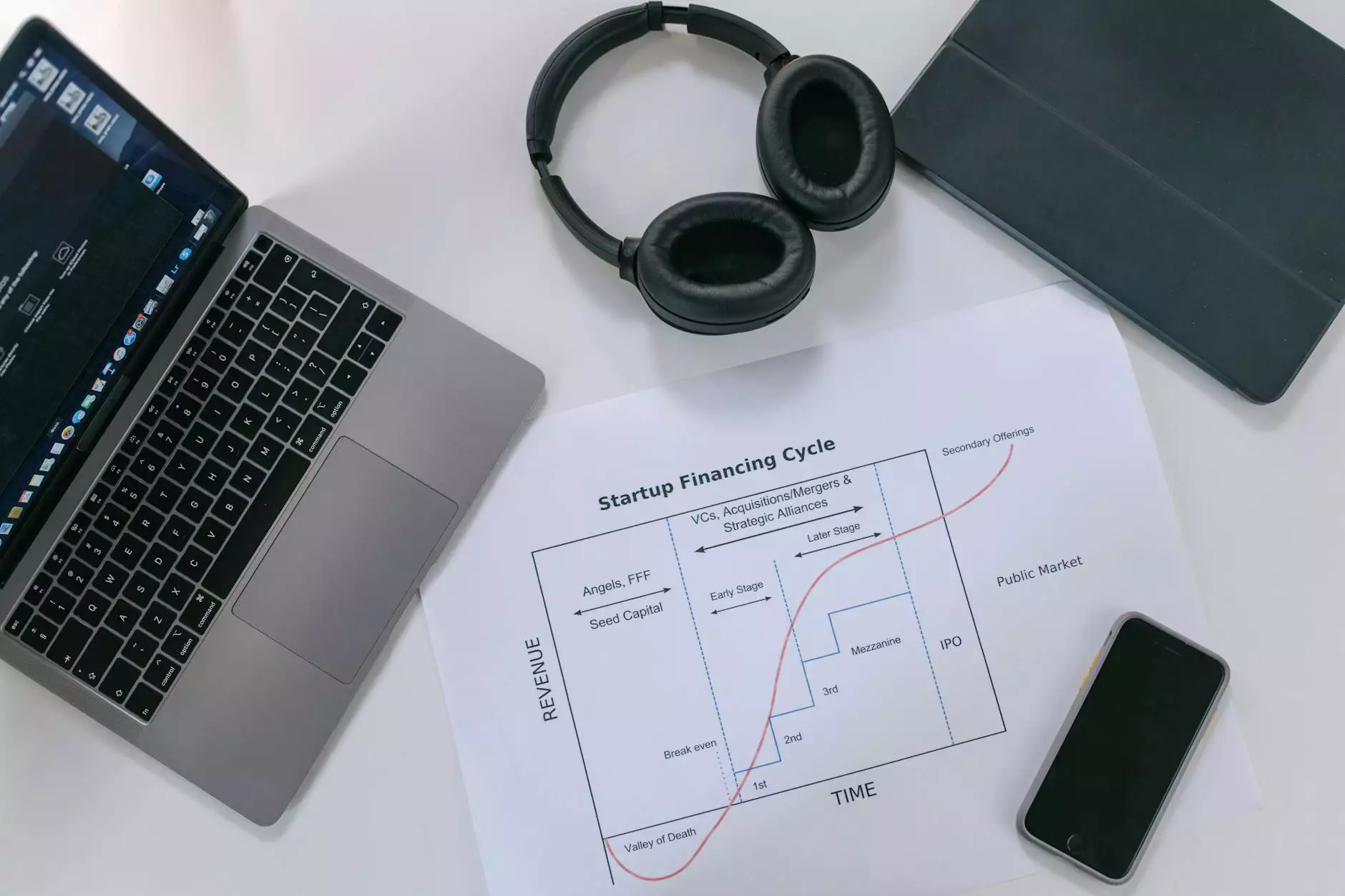

The Rise of Peer-to-Peer Lending

Peer-to-peer (P2P) lending has emerged as a game-changer in the finance sector. With platforms dedicated to connecting borrowers with private lenders, obtaining a laen eraisikult has never been easier. P2P lending platforms operate by allowing individuals to list their loan requests while investors can browse these requests and choose to fund them. This modern approach has made loans more accessible and often more affordable.

Benefits of Laen Eraisikult

- Flexible Terms: Unlike traditional loans, the conditions of a private loan can be tailored to meet the specific needs of the borrower. This includes interest rates, payment schedules, and loan duration.

- Speedy Approval: Securing a laen eraisikult often involves a more streamlined process, with fewer bureaucratic hurdles compared to banks. Borrowers can receive funds quickly, often within days.

- Potentially Lower Interest Rates: Private lenders may offer more competitive interest rates than banks, particularly for those with good credit histories.

- Less Stringent Eligibility Requirements: Private loans are generally more accessible for individuals with less-than-perfect credit or those who have unique financing needs.

Understanding the Risks

While taking a laen eraisikult can be advantageous, there are risks involved that every borrower should consider:

- Lack of Regulation: Private loans may not have the same protections as traditional bank loans. Research the lender and read all terms carefully before committing.

- Variable Interest Rates: Unlike fixed-rate bank loans, some private loans come with variable rates which can increase over time, making repayment more challenging.

- Potential for a Strained Relationship: If borrowing from a friend or family member, ensure clear communication to avoid misunderstandings that could affect personal relationships.

How to Secure a Laen Eraisikult

1. Determine Your Needs

Identify the amount you need and the purpose of the loan. Whether it’s for renovations, starting a business, or consolidating debts, having a clear goal will help you communicate effectively with potential lenders.

2. Research Potential Lenders

Look for reputable P2P lending platforms and private individuals willing to lend. Read reviews and seek recommendations to ensure you’re working with trustworthy parties.

3. Prepare Your Proposal

When approaching a private lender, prepare a comprehensive proposal. Include details about your financial situation, the loan amount requested, the purpose of the loan, and how you plan to repay it. Transparency is key.

4. Negotiate Terms

Once you find a potential lender, discuss and negotiate terms that work for both parties. This includes interest rates, repayment schedules, and any collateral involved.

5. Formalize the Agreement

Before receiving any funds, it’s crucial to have a formal loan agreement. This should be in writing and outline all terms and conditions discussed, ensuring both parties understand their responsibilities.

Reinvest.ee: Your Trusted Partner in Financial Services

At reinvest.ee, we are specialists in connecting individuals seeking financial solutions with private lenders. Our aim is to facilitate a smooth borrowing experience, providing clear information and support throughout the process of acquiring a laen eraisikult.

Conclusion: Making Informed Financial Decisions

In conclusion, a laen eraisikult can open up new avenues for achieving your financial dreams—be it renovating your home, managing unexpected expenses, or investing in your future. However, it’s essential to weigh the benefits against the risks and conduct thorough research before making decisions. At Reinvest.ee, we empower individuals with the knowledge and resources to make informed financial choices. Whether you are considering a private loan or exploring other financial services such as real estate financing or title loans, we are here to assist you each step of the way.

For more information and personalized advice, visit reinvest.ee today and take the first step towards achieving your financial goals!